Hotel Accounting Software & Bookkeeping Service.

Accounting Software & Bookkeeping Service

Deprecated: preg_split(): Passing null to parameter #3 ($limit) of type int is deprecated in /home/dailwtkh/public_html/wp-content/themes/jannah/framework/functions/post-functions.php on line 863

Hotel Accounting Software & Bookkeeping Service.

Using Hotel Accounting Software can simplify the day-to-day humdrum accounting routine of running a hotel. It can help with the daily task’s automation in the back office, which otherwise costs countless time and effort. Let’s dive deep into the details!

The accounting software for hotels should provide detailed information about your financial position, which can be easily interpreted and analyzed. It should support a variety of hotel ownership structures and provide flexible charts of financial information. The program should also be compliant with accepted accounting standards. Once installed, it will allow you to quickly review your financial statements to determine if any adjustments are needed. Moreover, it will allow you to track your inventory levels, which are essential for cost control.

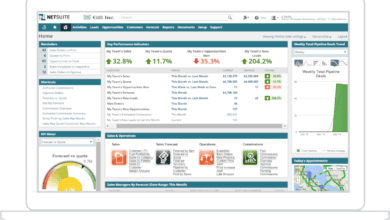

Many hotel accounting software programs are available in the cloud. And, the cloud-based solutions are easy to use and provide easy access to financial information. They can help hotel management by automating various financial processes and reporting across multiple brands. Nimble’s user-friendly interface enables you to manipulate its features and schedule accounting report generation.

In addition to offering advanced functionality, Hotel Accounting Software also offers support services. For example, Nimble provides full-time accounting specialists to provide training to hotel staff and support for implementation. They will help you implement the software, and ensure that the books are compliant with the latest requirements. If you have any questions, you can always schedule a free demo.

One of the benefits of Hotel Accounting Software is its ease of use. Using it is easy and efficient. It can streamline your processes and reports and help you control costs. Moreover, it reduces your customer service inquiries and phone calls. And, it can help you manage finances better and increase your profitability. You can now make informed decisions regarding your finances with Hotel Accounting Software.

Hotel accounting software is important for a hotel’s daily operations. Using a good one will allow you to make the right decisions and track revenue. Unlike manual methods, accounting software can eliminate all the problems and ensure accurate accounting. You can focus on other critical tasks such as hiring the right staff and improving guest satisfaction. Once you implement the right software, you will have a successful hotel running without any cash flow problems.

The hotel industry has unique reporting needs which costs account for 43% of the hotel’s operating expenses. Rising reporting will have a greater impact on hotels. For this reason, a budget-friendly and customizable hotel reporting software can be an effective investment for the future of your business. Nimble provides a 360-degree view of your finances. In addition, it is easy to use and does not require costly hardware installation.

The advantages of Hotel Accounting Software are numerous. Apart from allowing you to control operational costs, it helps you maximize revenues. It also frees up the accountant’s time, which can be used for other crucial tasks. With the right accounting system, you can streamline the whole process and keep your business running smoothly. It is an essential component of any hotel.

Hotel accounting software integrates your financial and accounting functions into a single platform. It allows you to close books faster and handle month-end activities with fewer errors. With good hotel software, you can track and analyze every aspect of your business. Besides, it will provide you with a complete portfolio management snapshot. Moreover, it will be easy for you to run the software.

Let’s now explore Hotel Bookkeeping Services

Hiring a Hotel Bookkeeping Service can help you manage your business efficiently. It is essential to keep proper records to ensure that you pay your employees on time. This is particularly important for hotels that plan to expand.

However, it can also result in financial problems if the accounting is not properly maintained. Outsourcing this work is a great way to save time and money while getting professional assistance and advice. The following are some of the benefits of hiring a hotel bookkeeping service:

The best hotel bookkeeping service will automate the processes necessary for hotels to keep their finances in order. It can provide hotel-specific reports to improve your flexibility and make your operations more efficient. It will also allow you to recognize risks in your business.

Although cutting costs on an outsourced bookkeeping service might seem like a good idea, it can end up costing you more. A single mistake in a financial report can be costly for you and your business. This will make it much more difficult to monitor cash flow, meet taxation laws, and maintain accurate financial records.

A hotel bookkeeping service can streamline the accounting processes, as well as give you access to real-time analytical data. These reports will help you identify financial gaps and improve your flexibility. The right hotel bookkeeping service provider will be able to give you access to real-time financial data, which will help you make informed decisions.

Most importantly, you will be able to focus on growing your business rather than managing your finances. And by outsourcing your bookkeeping, you’ll be able to reduce the amount of stress you have to deal with every day.

Hiring a Hotel Bookkeeping Service will alleviate the burden and stress of the bookkeeping process. The right accounting service will make sure that you stay compliant with tax laws, and it will save you time. With a Hotel Bookkeeping Service, you can access your budgetary information in the cloud. This will ensure that you aren’t paying more than you need to, so you’ll never have to worry about taxes again!

Outsourcing your bookkeeping is a great way to save money, as you won’t have to invest in expensive databases. You’ll also save time. Having someone else handle your accounting can be an invaluable asset to your business. When you hire a Hotel Bookkeeping Service, you will be able to focus on growing your business, rather than worrying about your financial records. You can focus on making more money by giving your staff more time to do what they love.

A professional Hotel Bookkeeping Service will be able to handle all of your hotel’s accounting needs. They will have the tools to maintain all of your accounts, including preparing tax forms. Your bookkeeping service will also have the latest software and tools to manage your budget. Whether you need assistance with your bookkeeping or you need to outsource the work, the experts will be able to help you.

A Hotel Bookkeeping Service will help you stay organized by ensuring your financials are accurate. These professionals are highly experienced and understand the intricacies of the hospitality industry. They will keep track of your accounts in accordance with the Uniform System of Accounts for the Lodging Industry (USALI) and other regulations. Your bookkeeper will be able to provide you with the right reports for your budget.

Moreover, a qualified service will have access to your hotel’s specific accounting information. A Hotel Bookkeeping Service will also be able to provide you with timely financial information. This way, you can focus on other important aspects of running your business. A professional bookkeeping service will take care of your accounts. This includes preparing your monthly budget.

A professional hotel bookkeeping service will be able to prepare and maintain your financial reports and provide you with valuable insight into the business. They will also be able to train your in-house accounting staff. Further, a Hotel Bookkeeping Service can also provide you with valuable information. This way, you can focus on other important tasks, such as developing your brand.

Difference between Hotel Accounting and Bookkeeping

The main function of accounting is to determine the profitability of a business. In some cases, a manager will use the data in management accounts to determine. What areas of the business need improvement and which ones can be cut. For example, a manager may need to make decisions about which parts of the business should be streamlined and improved.

A professional accountant can provide the right financial advice for a hotel. An accountant can review your finances and advise you on ways to improve them. Proper accounting also involves the depreciation of assets. Taking this into account is important, as many hotel investments lose value over time. If you are unsure about the difference between Hotel Accounting and Bookkeeping. It’s best to hire a professional who knows the industry inside and out.

In addition to managing cash flow, bookkeepers are responsible for maintaining accurate records of expenditures and income. These records can help the business avoid overspending by monitoring expenses and making sure the finances are balanced. This is essential for the sustainability of a hotel. However, hotel bookkeeping is not an easy task and requires a high level of detail. If your hotel has a small team of employees, it can be difficult to keep track of everything.

When you’re running a hotel or other hospitality business, it’s crucial to keep an accurate track of your cash flow. By keeping detailed records of your expenditures and income. You can make informed decisions that will ultimately improve the success of your business. And while accounting is an important part of any business, it’s also an essential aspect of running a successful hotel. In addition, a hotel’s operations are dependent upon accurate and timely accounting.

A hotel has a variety of revenue streams. These include room service, an on-site restaurant, conference room rentals, and even room service. Keeping accurate records of all of these is crucial for the sustainability of your business. It is crucial for the smooth functioning of a hotel to be profitable. Having a good accounting system in place is essential for this purpose. A good management team will have the ability to identify and correct mistakes in time.

When you’re running a hotel, the importance of guest satisfaction is evident in all aspects. From preparing the room to handling the food and beverages, every aspect of the hotel touches on a guest’s experience. As such, accounting is a crucial element of running a hotel business. The wrong way to record a transaction could hurt the business’s reputation or even lead to a poor guest experience.

In addition to the financial aspect of accounting, hotels need accurate records to accurately plan and allocate resources. Without accurate records, it is impossible to plan and grow effectively. It is essential to keep consistent financial records. For instance, having a consistent accounting system is necessary to create realistic budgets and plan for future expenditures. Moreover, hotel payroll processing requires the accuracy of timesheets. A hotel’s accountant must ensure that the employees are paid on time.

Although the two terms have some similarities, they have major differences. Generalist accounting is more accurate when a hotel is run by the same people. Those in the industry who work in hospitality need to know about the intricacies of both industries. In some cases, the differences can be vast. Those who are familiar with the terms should choose the right service. They should be able to understand how each of these two terms works.