Can You Borrow from Your 401k for Home Improvement Projects?

401k Loan and How Does it Work

Deprecated: preg_split(): Passing null to parameter #3 ($limit) of type int is deprecated in /home/dailwtkh/public_html/wp-content/themes/jannah/framework/functions/post-functions.php on line 863

Home Improvement projects can add value and comfort to your house but they could also be quite costly. You might consider borrowing against your 401(k) when funding those projects.

Most employer plans let you withdraw up to 50% of your vested account balance so long as the cash is less than either $50,000 total or half your retirement savings. However, one exception to this limit arises in situations where less than $10,000 equals 50% of the vested account balance. If that is true for a given participant then they can borrow up to $10K.

For more information on what a 401(k) loan is and how it works, including the pros (and cons), read this article.

What is a 401k Loan and How Does it Work?

401(k) Loans To pay for certain expenses, borrowers can temporarily remove money from their 401k account using the loan. 401(k) loans can be a reasonable alternative to personal, payday and home equity financing in the right circumstances. Especially if you want to stay away from the rapacious rates of interest attached to other forms involving temporary financing.

If you are like most loans, the lender gives you money and you promise to pay this amount back over time (with interest). Next, time to tap your 401(k) plan for a loan You use money from your traditional or Roth IRA plan as collateral to secure a personal loan.

-

How to Apply for a 401k Loan

There is usually no deception while applying for a 401(k) mortgage. To learn more about the application process;

- which usually entails filling out a form and indicating the mortgage amount

- contact your plan administrator

After approval, the money will be sent into your account, and you can begin making payments through payroll deductions.

-

Loan Terms and Conditions

- Additionally, here the limit is $50k on loans which means you can borrow half your invested account balance.

- The interest can go back into your 401k account and typically earns prime +1 or 2% tax.

- Five years sounds like a long timeframe for repaying the mortgage, but it can be extended if the property is your primary dwelling.

- You must also pay back the whole balance of your loan within 60 days after you leave that job.

What Are the Pros and Cons of Using a 401k for Home Renovation?

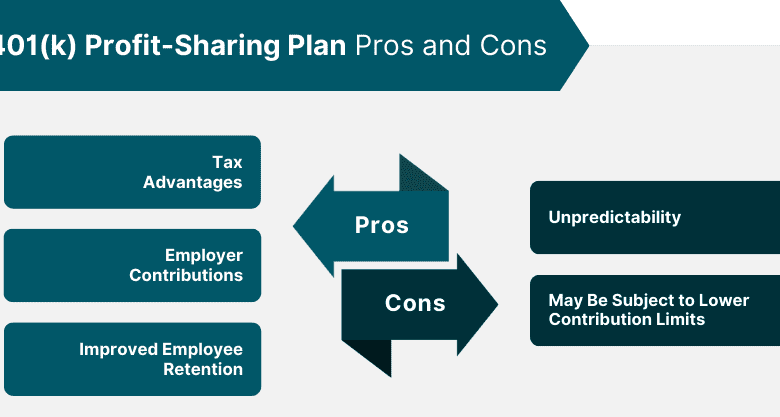

There is a list of advantages and disadvantages of financing home repairs from one’s 401(k).

Benefits of Borrowing from Your 401k

- You will receive your money within a short time. The loan can be processed in as little as six days.

- If you are borrowing money from yourself, then no credit check.

- Most 401k loans have a relatively low interest rate compared to other types of borrowing (personal, credit cards…..etc).

Potential Drawbacks and Dangers to Retirement Funds:

Your retirement savings may not grow as rapidly now that the borrowed funds are not being invested.

Pressure to Repay: If you lose your employment, you must repay the mortgage in full within a short period or face tax implications.

Possible Consequences: If you are unable to repay the loan, the outstanding amount could be subject to income taxes and, if you are younger than 59½, an early withdrawal penalty of 10%.

What are the Alternatives for Home Improvement Projects?

There might be more suitable financing alternatives, but you can always take out a loan from your 401(k).

401k Loans vs. Home Equity Loans vs.

| Feature | 401K Loan | Home Equity Loan |

| Source of Funds | Retirement savings in your 401k account | Equity in your home |

| Interest Rates | Higher than Home Equity Loans | Generally lower |

| Tax Deductibility | Interest is not tax-deductible | Interest is often tax-deductible |

| Credit Check Required | No | Yes |

| Impact on Retirement | Reduces retirement savings temporarily | No direct impact |

| Repayment Terms | Typically, 5 years, with some exceptions | 5-30 years |

| Risk of Job Loss | The loan may become due immediately if you leave your job | Not affected by employment status |

| Application Process | Simpler, through your 401k plan administrator | More complex, may involve appraisals and closing costs |

Personal Loan for Home Improvement

For good-credit borrowers: Personal loans Private loans were made with much lower interest rates than 401(k) mortgages, so no risk was done to any retirement accounts.

How Can You Use a 401k Loan to Finance Home Improvements?

Before going forward with a home improvement project, you should carefully consider one 401(k) loan alternative. Here are the steps::

Steps to Fund Your Home Improvement Project

1. Determine the price:

Determine how much finance you will need for your home improvement projects to borrow the precise amount.

2. Submit a loan application:

To start the loan application process, you should speak with your plan administrator.

3. Calculate Your Return:

To keep from becoming overwhelmed, plan for the payroll deductions that will pay down your loans.

Top Projects Financed by 401(k) Plans

We renovate kitchens: In terms of desired outcomes and rewarded outcomes, a kitchen makeover is typically the one that increases the home’s worth the most.

Modernizing the Bathroom: A bathroom remodel is another common home improvement project that usually pays off.

Extending Your Home: The majority of 401(k) loan applications are for room extensions, such as an extra bedroom or office.

Total Home Improvement Cost Estimation

Estimate how much you will require for the endeavour before borrowing. Avoiding troubles with money by trying to borrow only what you actually need.

What Are the Tax Implications of Borrowing from Your 401k?

Before taking out a loan from your 401(k), you should know what the tax consequences would be.

Understanding Withdrawal Penalties

If you are unable to return your 401(k) loan, the substantial balance might be treated as a distribution, which would be subject to income tax and, if you are younger than 59½, a 10% early withdrawal penalty.

Taxable Events and Their Consequences

Your financial status could be significantly impacted by a taxable event that occurs as a result of a mortgage default. Understanding these results before borrowing is essential.

IRS Regulations on 401k Loans

IRS laws are very strict on 401k loans and set limitations about re-contributions along with payback periods or else face stiff penalties. Get to know their principles and avoid expensive mistakes.

What Should You Consider Before Borrowing from Your 401k?

Things to consider before borrowing from your 401(k):

Examine Your Current Financial Condition

Look at your current financial state to see how much of a monthly payment you can afford. Before withdrawing cash from your 401(k), won’t put your financial security at risk before you do it.

Hiring a Financial Expert

A financial advisor can give you some advice on whether taking a loan out against your 401k is a good choice as well as other means of financing.

How It Will Affect Your Retirement Plan in the Long Run

Think about how that loan would impact your retirement savings in the long run before borrowing from your 401(k). The dwindling of funds in your retirement fund will affect the future a lot.

Wrap Up:

In conclusion; find out what kinds of loans are available to you, and then consult a financial advisor before making a final decision. This will maximize the utilization of your available funds.

It is risk-free to withdraw money from your 401(k) to pay for various home improvement projects. Before you take out a loan you should make sure that you have a thorough understanding of how these loans work. How they impact your retirement funds, and the potential tax ramifications.

Simply desire to say your article is as surprising The clearness in your post is simply excellent and i could assume you are an expert on this subject Fine with your permission let me to grab your feed to keep up to date with forthcoming post Thanks a million and please carry on the gratifying work

Wow amazing blog layout How long have you been blogging for you made blogging look easy The overall look of your web site is magnificent as well as the content