NASDAQ is the largest stock market in the world where it gives information on the performance and future of a listed company. This is one of the major reasons why many businesses and investors place their investment on NASDAQ. This is also one of the reasons why many companies listed on NASDAQ are capable of reaching new heights and eventually become very successful. This means that even small organizations and start-ups can gain exposure to the international market through the numerous listings on this stock market. The following is a detailed analysis of some of the factors which affect the trading of this stock on NASDAQ.

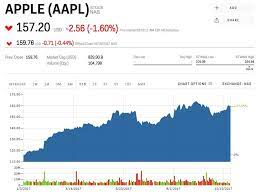

A lot has been said about Apple Inc. and its founder, Steve Jobs. One of the best things about Apple Inc.’s stock price is that it is highly unpredictable and highly volatile. Many investors use this to their advantage by riding the wave of the trend and its upswings to make huge profits. However, there is no way to know exactly what will happen next since we never know what will be the course of history. That is why it is important to closely monitor the market when you’re planning to invest in a certain stock like Apple Inc.

There are many different business concepts that made their way into the business world. One of the most successful of these concepts is the marketing strategy known as branding. This concept is one of the main reasons why Apple and its founder are able to flourish in the global market. By using the highly recognizable name of Apple and continuously improving the design of their products, they were able to establish a solid image that customers can easily associate with and that would guarantee repeat business from them.

Aside from the highly recognized brand name, there are also other more intangible benefits that NASDAQ AAPL at https://www.webull.com/quote/nasdaq-aapl has gained from its extensive business portfolio. One of these is the value of diversification. As an established company, it has diversified its assets to include many varied industries including hardware, software, retail, telecommunications, supply chain management, and Internet services. Thus, it was quite easy for investors and businesses to gain access to an increasing number of options that can make it possible to gain profit regardless of the state of the economy. The same holds true for Apple Inc. The USA. The diversity of business operations and diversification of strategies allow investors to benefit from diversified risks and maximize returns.

However, despite the benefits that investors can gain from diversification, sometimes it is not enough to gain profit and at times when all efforts seem to have failed, stock analysis can provide some clues about the status of the stock and its price movements.

Stock analysis, however, should never be taken for granted. It is necessary to perform the necessary research and analysis before deciding on the buying or selling of stocks. Doing the necessary research is not a very complicated process but rather requires time, patience, and thorough analysis of the specific company information and stock charts. It is best to conduct the analysis yourself, but if you don’t have the time and the resources to do so then hiring a professional stock analysis firm to do the job for you can be a great option. You can find more stocks like NASDAQ ctrm at https://www.webull.com/quote/nasdaq-ctrm for investing.

If you desire to take

much from this piece of writing

then you have to apply these strategies to your won webpage.

of course like your web-site however you need to take a look at the spelling on several of your posts. Several of them are rife with spelling problems and I in finding it very bothersome to inform the reality nevertheless I will definitely come again again.

clonopine meaning hydroxychloroquine price plaquenil 400 mg

I wanted to thank you for this great read!! I absolutely loved every little bit of it. I’ve got you book-marked to look at new stuff you post…|

It’s an awesome piece of writing designed for all the online users; they will obtain advantage from it I am sure.|